China’s BYD announced it will collaborate with the Xuzhou Economic Development Zone located in Jiangsu, China, to construct a sodium-ion battery production base, and the parties will also jointly establish the world’s largest micro-car sodium battery system supplier. The project marks BYD’s significant entry into the sodium-ion battery market, leveraging the technology’s potential for applications in EV and energy storage solutions.

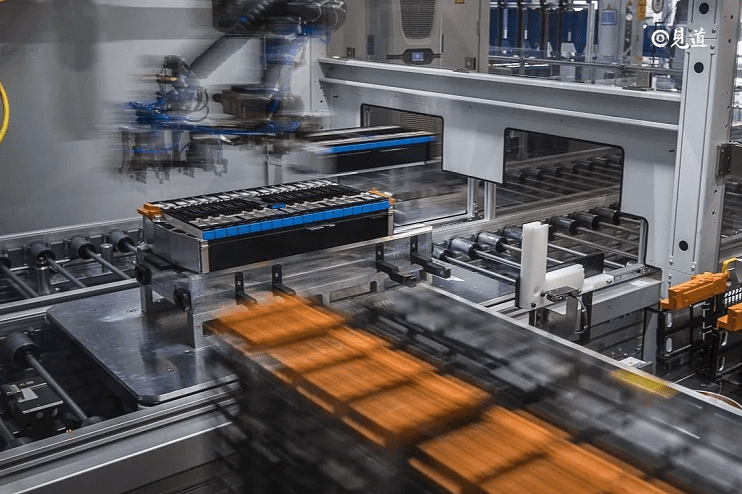

On November 18, 2023, the two parties formally signed the investment agreement for the sodium-ion battery production base project, with a planned total investment of $1.38 billion USD (10 billion yuan). The project will primarily focus on producing sodium-ion battery cells and related PACK products.

To manage this substantial project, the two parties jointly invested 500 million yuan to establish a new company—Huaihai Fudi Sodium Battery Technology. BYD’s subsidiary Fudi Battery holds 51% of the shares, while Huaihai Group holds 49%. The company’s business scope includes battery manufacturing and sales, as well as the recycling of used power batteries.

This development signifies that BYD, armed with a $1.38 billion project, has officially entered the sodium-ion battery sector.

Sodium-ion batteries are an emerging energy storage technology. In recent years, they have garnered increasing attention from relevant research institutions and industry stakeholders.

Research indicates that while sodium-ion batteries have the potential to become significant energy storage solutions, they also have inherent limitations.

Due to the larger radius of sodium ions compared to lithium ions, sodium ions contain relatively less energy per unit mass. This results in sodium-ion batteries having lower energy density, which is a major drawback.

Consequently, sodium-ion batteries have greater potential in areas where energy density requirements are lower.

For example, in low-range, short-distance vehicles, as well as in household and commercial energy storage applications where safety is paramount, sodium-ion batteries are poised to complement lithium batteries and replace lead-acid batteries.

Based on cathode materials, sodium-ion batteries can be categorized into three major types: layered oxides, Prussian blue, and polyanionic compounds.

Polyanionic sodium-ion batteries have advantages such as long cycle life, low cost, and high safety, making them suitable for large-scale energy storage. Layered oxide sodium-ion batteries offer higher energy density, lower cost, fast charging, and strong low-temperature performance, making them ideal for A00 or A0 class vehicles.

BYD employs a dual strategy of both layered oxides and polyanionic compounds. Therefore, the primary focus of BYD’s major project is on micro-vehicles and the PACK sector.

In recent years, leveraging the broader trend of energy storage development, sodium-ion batteries have emerged as a strong contender among various alternatives to lithium-ion batteries.

Data shows that sodium-ion battery productivity were approximately 3GWh in 2023. This is expected to increase to 30GWh by 2025 and exceed 300GWh by 2030. The high-growth prospects of the industry have attracted numerous participants.

To date, battery manufacturers such as CATL, EVE Energy, Guangzhou Great Power, and Ningbo Ronbay New Energy have announced plans for sodium-ion batteries and electrode materials, committing to the industrialization of the sodium-ion battery supply chain.

In the automotive sector, domestic car manufacturers like BYD, JAC, JMC, and Chery, along with several overseas car manufacturers, have announced plans to introduce sodium-ion batteries into the passenger car market.

According to incomplete statistics, over 200 companies in the industry are currently competing in the sodium-ion battery space.

In terms of industrialization, a few sodium-ion battery projects are under construction in China, such as the Sichuan Xingkong Sodium-ion Battery Industrial Project and the Xingchu Century 5GWh/year Sodium-ion Battery Project.

Overall, the sodium-ion battery industry is in its early stages of development. Whoever can develop higher-performance products and achieve mass production first will gain a competitive advantage in this evolving market.

Major domestic manufacturers have accelerated their efforts in sodium-ion battery research and development. Leading power battery manufacturer CATL has released its first-generation sodium-ion battery and is currently developing the second generation, which is expected to perform better in terms of cost, lifespan, and low-temperature performance.

BYD has announced its capability to produce 150Ah blade sodium-ion cells. Additionally, its 20MWh “sodium-ion battery cube system” has been put into trial operation at the Nanning Qingxiu Industrial Park.

BYD has also outlined a detailed roadmap for sodium-ion batteries. By 2025, it is expected that the energy density of layered oxide systems will reach 180Wh/kg with 6000 cycles, while the energy density of polyanionic systems will reach 150Wh/kg with 10000 cycles.

Today, BYD’s major sodium-ion battery project undoubtedly becomes a critical asset in its competitive edge within the sodium-ion battery sector.

Source: The China Academy, June 30, 2024. https://thechinaacademy.org/byd-invests-10-billion-to-a-game-changing-battery-technology/

References