In the rapidly evolving landscape of global automotive technology, Chinese charging stations have become a cornerstone of the international charging infrastructure, mirroring the country’s burgeoning prowess in new energy vehicles (NEVs).

Recently, a representative from a leading Chinese charging station company announced a significant surge in exports, with figures climbing from 30,000 units in 2021 to an impressive 150,000 units in 2023. This growth is indicative of the global demand for robust and efficient charging solutions that Chinese companies are uniquely positioned to supply.

The rise in Chinese automotive exports has been meteoric, with the China Association of Automobile Manufacturers reporting that in 2023 alone, the country exported 4.91 million vehicles, including 1.203 million NEVs. This marks a substantial year-on-year increase, underscoring China’s role as a global automotive export powerhouse and a leader in NEV technology. As the demand for electric vehicles continues to accelerate worldwide, the need for comprehensive charging solutions has become more apparent, propelling Chinese charging stations to the forefront of the market.

According to Alibaba International’s Cross-Border Index, there was a 245% increase in overseas sales of Chinese NEV charging stations in 2022 alone, with predictions suggesting that the global market value could reach approximately 113.2 billion yuan by the next decade. This burgeoning market has prompted Chinese companies to expand aggressively into international territories, often finding their innovative charging station modules in short supply due to soaring global demand.

One of the key reasons for the international success of Chinese charging stations is their cost-effectiveness and performance. Industry experts acknowledge that the markets with the highest demand for NEVs—namely China, the U.S., and Europe—also see a corresponding demand for charging stations. Chinese manufacturers leverage domestic supply chain efficiencies and offer flexible, customizable services that are particularly appealing in overseas markets where such customization can be prohibitively expensive.

Moreover, the ratio of cars to charging stations is a critical metric that underscores the need for more infrastructure. In Europe and the U.S., the public charging station ratios lag significantly behind China’s 7.5:1, indicating a substantial opportunity for growth in these regions. The International Energy Agency projects that by 2030, the global landscape will require millions of new charging stations, including both fast and slow charging options, to accommodate the burgeoning fleet of electric vehicles. In response to these market dynamics, major Chinese players like Teld, New Charging, Shenghong, Autel, JuHua Tech, and Hezhihui Digital Energy are intensifying their international operations. Their products are being rapidly deployed across global markets immediately upon production, highlighting the perpetual demand for Chinese charging solutions.

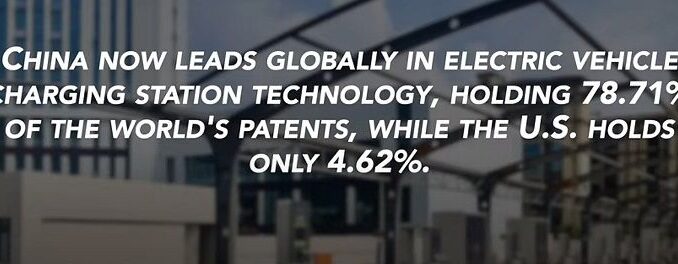

As China continues to dominate the global EV market, the contrast with the U.S. becomes stark. Despite substantial investments, the U.S. has struggled to scale its charging infrastructure effectively.

US initiatives such as the 2021 Infrastructure Bill, which allocates $7.5 billion to develop a national network of charging stations, reflect a concerted effort to catch up with China’s advancements. The global competition in charging station technology is not just a race for market dominance but also a strategic alignment of national policies, technological innovations, and sustainable practices.

As countries around the world grapple with the challenges and opportunities of transitioning to electric vehicles, the developments in the charging station sector remain a critical area of focus.\

Source: Project Nexus, May 17, 2024.