New Development Bank: Argentina, Saudi Arabia, Zimbabwe new members

The BRICS bloc of Brazil, Russia, India, China, and South Africa is expanding, and building a new economic architecture to challenge the dominance of the U.S. dollar.

One of the most important institutions created by the BRICS is the New Development Bank (NDB). This is a Global South-oriented alternative to the World Bank, which is located in and essentially controlled by the United States.

In March 2023, the NDB inaugurated its new chief: Dilma Rousseff, the former president of Brazil, from the South American nation’s leftist Workers’ Party.

Flags of the members of the BRICS bloc’s New Development Bank (NDB)

Rousseff has stressed that the NDB’s goals are financing “infrastructure investments” and “helping our members combat poverty, create jobs, and promote environmentally sustainable development”.

She has also welcomed several more countries to join the bank.

Current NDB members include the five BRICS nations as well as Bangladesh, the United Arab Emirates, and Egypt. Uruguay is already in the process of joining.

Rousseff revealed on June 1 that four more countries have been approved as new members: Argentina, Saudi Arabia, and Zimbabwe.

Rousseff said NDB leadership okayed these countries’ membership request, and the decision will officially be announced in August, at the summit of BRICS heads of state, which will tentatively be held in South Africa.

The new NDB president disclosed this news while Argentina’s economic minister, Sergio Massa, was visiting the bank’s headquarters in Shanghai, China.

Brazil’s President Lula da Silva, who helped found the BRICS during his first two terms in the 2000s, returned to office in January 2023.

Lula has played a key role in advocating for Argentina to join BRICS. In a summit of South American leaders in Brazil in May, Lula also endorsed Venezuela joining the bloc.

BRICS bank commits to de-dollarizing

On May 30 and 31, the New Development Bank held its annual meeting—the institution’s eighth since it began operations in 2015.

NDB President Rousseff used the special occasion to reiterate that the bank’s objective is eventual de-dollarization.

The short-term goal is to offer 30% of NDB loans in local currencies. This would be an increase from its present rate of 22%.

In April, Rousseff had first announced that the NDB plans to transition away from the U.S. dollar, pledging that nearly one-third of its loan book will be financed in the currencies of member countries by 2026.

By diversifying its use of currencies, the NDB not only seeks to weaken the bloc’s dependence on the dollar, but also hopes to help developing countries avoid painful fluctuations in exchange rates.

The U.S. dollar is the global reserve currency, so Washington’s domestic monetary policy has an impact on the world economy (a phenomenon known as the Triffin Dilemma).

Since March 2022, the U.S. central bank, the Federal Reserve, has aggressively raised interest rates. This has put downward pressure on the currencies of many Global South nations, making it more expensive to import foreign products and pay off dollar-denominated debt, while also fueling capital flight.

“We need to create a diversified global currency system”, Rousseff said at the NDB annual meeting.

“In the future, it is unlikely that one single currency can dominate the world’s currency system. We will see more local currencies used to settle trade”, the NDB president added.

The New Development Bank has already issued bonds denominated in China’s currency, the renminbi.

Chinese Vice-Premier Ding Xuexiang said at the annual meeting of the BRICS bank that the “NDB is designed to better serve the emerging economies by financing more infrastructure construction and sustainable projects”.

Rousseff’s view, that the world is transitioning toward a multipolar currency order, has been acknowledged even by some Western mainstream media outlets and analysts.

The chair of the editorial board of the Financial Times newspaper, Gillian Tett, implored investors in March to “Prepare for a multipolar currency world“.

Prominent economist Zoltan Pozsar wrote in the Financial Times in January that the “unipolar era” of U.S. hegemony is over, and has been replaced with a “multipolar” order of “one world, two systems”.

Pozsar, whom the financial press dubbed a “superstar”, noted that “the pace of de-dollarisation appears to have picked up”, with more and more BRICS-curious countries trading in their own currencies.

“If less trade is invoiced in U.S. dollars and there is a dwindling recycling of dollar surpluses into traditional reserve assets such as Treasuries, the ‘exorbitant privilege’ that the dollar holds as the international reserve currency could be under assault”, Pozsar warned.

How the World Bank is controlled by the United States

Unlike the World Bank, the New Development Bank is a truly multilateral institution, not one dominated by a lone power.

The 2014 founding agreement stated that the NDB’s “initial subscribed capital shall be equally distributed amongst the founding members”, and the “voting power of each member shall equal its subscribed shares in the capital stock of the Bank”.

No country has veto power in the NDB.

The NDB founding agreement likewise stated:

The President of the Bank shall be elected from one of the founding members on a rotational basis, and there shall be at least one Vice President from each of the other founding member.

The World Bank is completely different. This institution is essentially controlled by the United States, and physically headquartered in Washington, DC.

The bank clearly states on its website that the United States “remains the largest shareholder of the World Bank Group today”, boasting that,

As the only World Bank Group shareholder that retains veto power over certain changes in the Bank’s structure, the United States plays a unique role in influencing and shaping global development priorities.

The bank’s website likewise admits,

Traditionally, the World Bank President has always been been a U.S. citizen nominated by the United States.

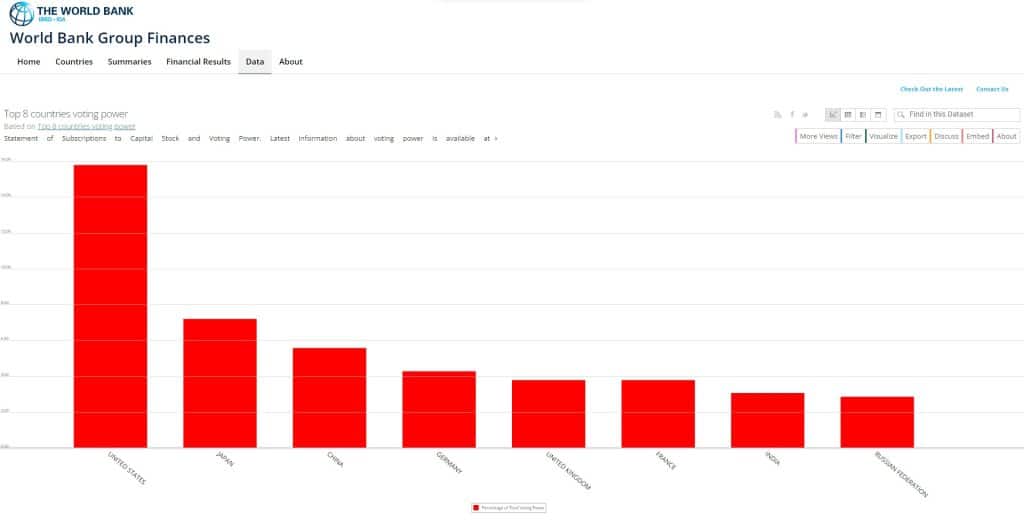

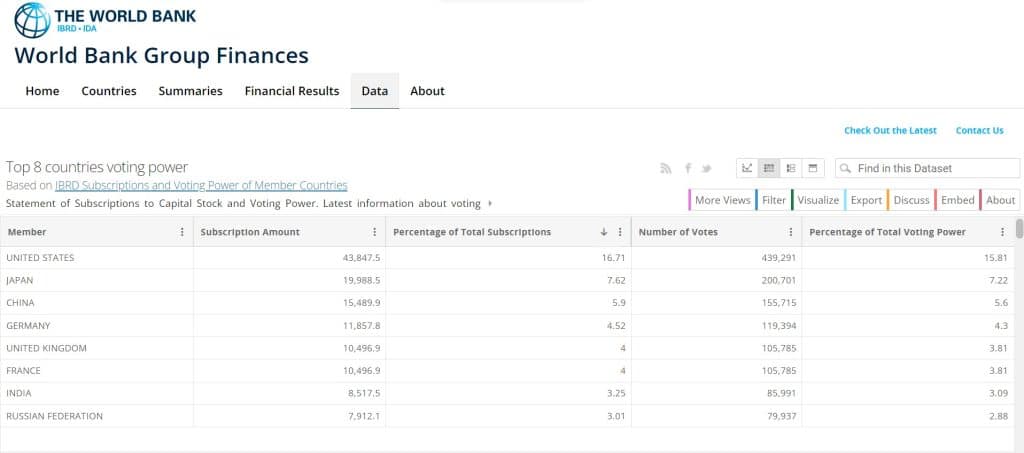

The United States has 15.81% voting power in the World Bank Group’s lending arm, the International Bank for Reconstruction and Development (IBRD). No other country even remotely comes close.

In second place in voting power is Japan, with 7.22%. Despite having four times the U.S. population, China has a vote share of just 5.60%. Germany has 4.30%, and Britain 3.81%.

India, with a population of more than 1.4 billion, is tied with France, which has a population of less than 66 million; each has 3.81% of the voting power in the World Bank.

Russia has a mere 2.88%. Canada has 2.56%, and Italy 2.50%.

The World Bank acts as a kind of neocolonial institution, dominated by the Western powers.

It is not so much the World Bank as it is the Washington Bank.

Along with its Bretton Woods financial sibling the International Monetary Fund (IMF), which is similarly dominated by the United States, the World Bank is notorious for trapping Global South countries in odious debt.

When debtor countries are unable to pay back the World Bank (or IMF), the U.S.-controlled institution frequently imposes harsh neoliberal economic policies, as part of a “structural adjustment” program, requiring the government to cut social services, lower wages, slash pensions, reduce spending on healthcare and education, end subsidies, privatize state-owned enterprises, and deregulate markets.

Former consultant John Perkins, in his book Confessions of an Economic Hit Man, described the World Bank as an “agent of global empire” that helps “cheat” poor countries in the Global South “out of trillions of dollars”, and subsequently “funnel money… into the coffers of huge corporations and the pockets of a few wealthy families who control the planet’s natural resources”.

Perkins added that the “economic hit men” at the World Bank and similar U.S.-dominated institutions “play a game as old as empire”. END.

Source: Geopolitical Economy Report, June 6, 2023.

https://geopoliticaleconomy.com/2023/06/06/brics-new-development-bank-dollar-adding-members/

Author: Ben Norton