US ATTEMPTS TO RESTRICT CHINESE GREEN TECHNOLOGY

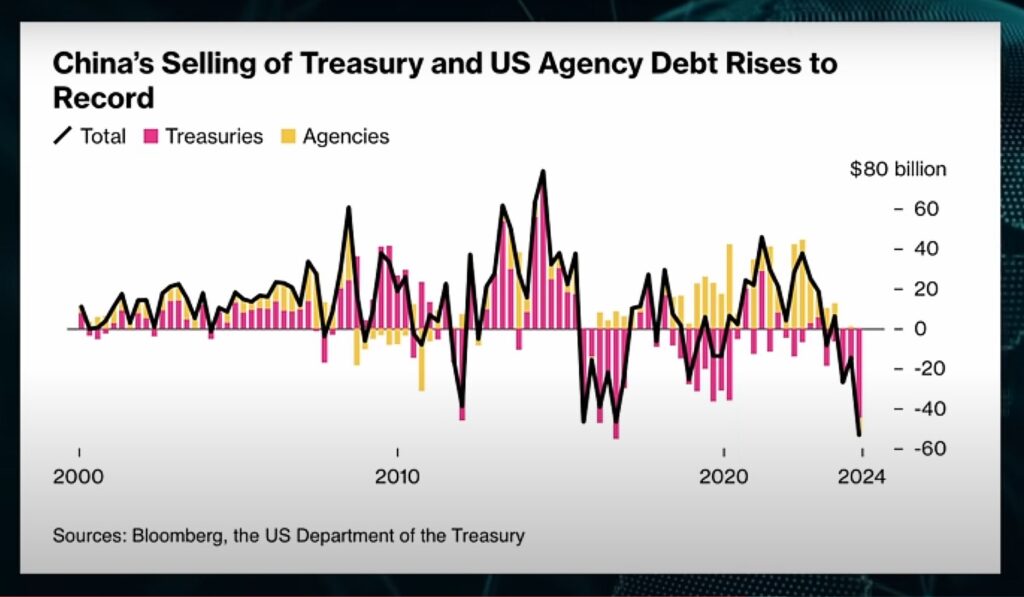

China dumps record $53.3 billion of US treasury and agency bonds in the first quarter of 2024.

The news of the largest ever Chinese sell-off of US dollar assets emerged following three recent key events:

- Five days after seemingly cordialtalks between top climate officials from China and the US when they met in Washington to discuss climate action, on May 9, 2024;

- The US announcement on May 14, 2024, of the imposition of a range of huge new tariffs on Chinese imports, including green technology products such as solar panels, electric vehicles, batteries, and green energy supply chain inputs;

- The historic agreements reached by Xi Jinping and Vladimir Putin at their meeting in Beijing on May 17, 2024.

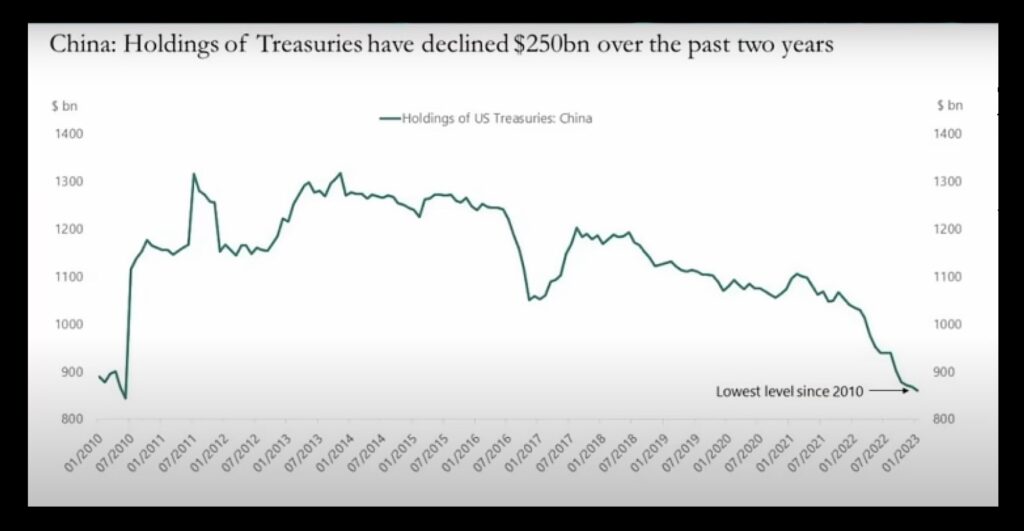

Over time China has significantly reduced its stake in the US treasury market, which was 14% in 2011 but had dropped to 3% by the end of 2023, according to the Bloomberg news agency.

Economist Lena Petrova, noted on Rumble that China began reducing its US dollar holding in 2015, following the 2014 US-orchestrated coup in Ukraine and the start of the civil war in the Donbas. US sanctions on Russia at that time highlighted to China the vulnerability of relying on the US financial system (see attached video).

Experience shows that this was a correct assessment by China, which today seeks to mitigate similar economic risks. The US-led West has frozen roughly $300 billion in Russian sovereign funds since the start of the Ukraine conflict. US threats of expropriations and sanctions, no doubt have prompted China to reduce its exposure to US Treasury assets to avoid being similarly targeted. The most recent round of US economic warfare on Chinese industries has shown this threat is real and growing.

China is still the second largest foreign holder of US Treasury securities after Japan. While China is selling dollar assets, its holdings of gold have surged in the country’s official reserves. The share of the precious metal in reserves climbed to 4.9% in April, the highest since records began in 2015, according to the People’s Bank of China.

At the same time the BRICS alliance is gaining strength and challenging the current world order, with emerging markets buying up gold because of economic uncertainties and geopolitical changes. The BRICS+ countries contribute today almost 50% to the world GDP vs only 19% in the year 2000. There is more capital available to exchange for physical gold.

This significant sell-off underscores China’s effort to reduce exposure to US financial assets amidst trade tensions and geopolitical concerns, aiming to hedge against economic and political risks in US-China relations.

Economist Lena Petrova explains this in more detail in the attached video.

Source: Lena Petrova, May 21, 2024. https://youtu.be/Jutm-rMwTwk

See also:

- South China Morning Post, https://www.scmp.com/…/what-are-14-chinese-items-us…

- RT News, https://www.rt.com/…/597933-china-us-securities-sell-off/

- Sputnik International, https://sputnikglobe.com/…/china-sells-off-record…

- China Environment News, https://china-environment-news.net/us-duplicity-tariffs…/